IRS + Spread: a simple guide to student loans

Understanding what IRS + Spread means can help you read loan terms with more awareness, compare different offers, and—most importantly—know what you’re really paying for. This guide breaks it all down, step by step, using practical examples and simple language—even if you’ve never dealt with finance before.

What is a fixed interest rate on a loan?

A fixed interest rate means the rate stays the same throughout the entire repayment period. Once agreed upon, it doesn’t change—so your monthly payments are always calculated with the same rate.

In student loans, the fixed rate is often written as:

IRS + Spread = Fixed Rate

What is IRS?

IRS stands for Interest Rate Swap. It’s a market-based reference rate that reflects how much it costs to “lock in” a fixed interest rate for a set number of years.

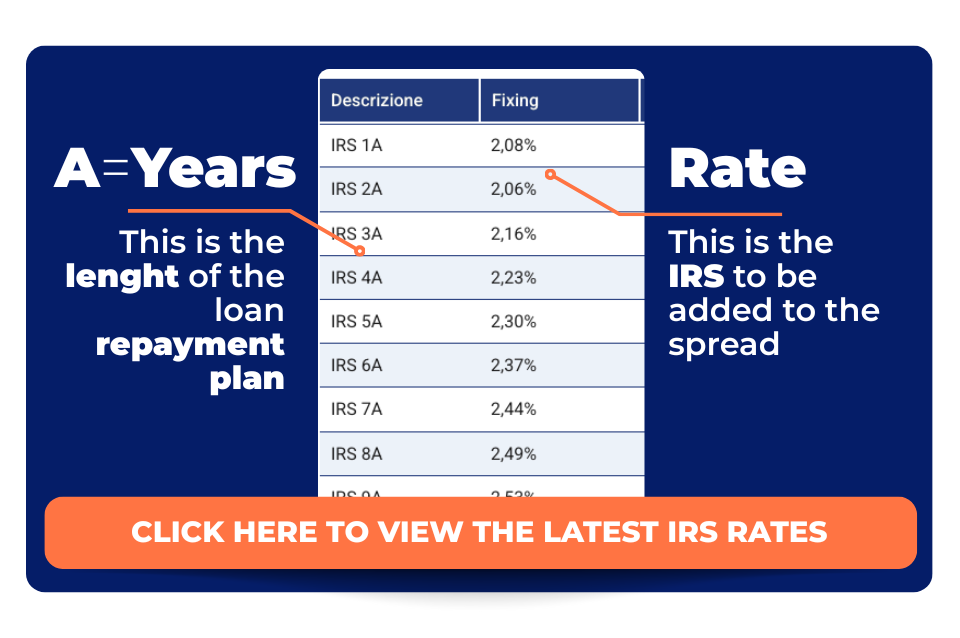

Each loan duration has its own IRS:

- IRS 5A → for 5-year loans

- IRS 10A → for 10-year loans

- IRS 20A → for 20-year loans

“A” stands for “years”. The IRS is updated daily based on market conditions.

Where to find it?

Check the updated IRS values here: IRS Table – Il Sole 24 Ore

Make sure to look at the “Fixing” column.

What is the spread?

The spread is the additional margin that banks or lenders apply on top of the IRS. It’s the “commercial” part of your loan’s rate, and it varies from one provider to another.

Example:

- IRS 10A = 2.8%

- Spread = 2.5%

- Fixed rate = 5.3%

What does “loan duration” mean in a student loan?

In a student loan, “duration” refers only to the repayment period, not the years spent studying.

Repayment starts about 30 months after the last disbursement (check your lender’s conditions). From that point on, you’ll pay fixed monthly instalments.

Example:

- Last disbursement: June 2025

- Repayment starts: December 2027

- Repayment duration: 10 years

- End of loan: December 2037

→ In this case, the applied IRS will be the 10-year rate.

⚠ Some banks may begin to accumulate interest during the pre-repayment period (the 30 months where you’re not yet paying back). Always check your loan contract carefully.

Related resources

Want to understand how a student loan really works?

Read the complete student loan guide

Curious how loan duration affects the total cost you pay?

Check out the article on interest rate and duration

News in evidence

Fondo per lo Studio: how it works and how to apply for a loan

4 January 2026

University loans in Italy: what they are and how they work

7 January 2026

Fondo per lo Studio: current rules and new updates

1 January 2026

Student loan: for which universities and educational programs is it available?

4 September 2025

Student loan: what it is, how it works, and why it could be your solution

4 September 2025

Habacus, credit broker: a new player in Italy’s student loan market

3 September 2025

How to pay for university with the “Fondo per lo Studio”

25 August 2025

How to pay for university for your son or daughter: a practical guide for parents

26 June 2025

Lezioni del Corriere & Habacus: a shared vision

18 June 2025

IRS + Spread: a simple guide to student loans

13 May 2025

Habacus Supports The Tide at the 2025 Venice Architecture Biennale: an installation merging art, artificial intelligence, and the voices of new generations

9 May 2025

Habacus at “Credito e Finanza 2025”: advancing student loans and the digital transformation

2 April 2025